Probably the most important “P” of marketing is the price for both customers and sellers. Pricing the product correctly earns profits for the company. Customers are also concerned about the price of items they purchase. Nobody buys anything without enquiring about the price, including companies selling products. They are also very concerned about the price of the raw materials they buy. If it is so important, companies must put much thought into it. Let us understand the theory of product pricing that guides a company to price its products.

The Advanced Executive Certificate Course In Product Management deals extensively with this topic and how companies must price their products to achieve maximum sales and profit. If you want to get information about this course, please visit our website.

The Theory Of Product Pricing

How do companies price a product? Surely there is a formula for this. This formula is based on the theory of product pricing, which states that the price of products or services depends on the relationship between demand and supply at that time. Everyone knows that prices rise when demand is more than supply, and when the situation is reversed, prices fall. It is said that the product achieves an optimal price when customers can consume the total number of products available in the market.

In a free market economy, prevalent in most parts of the world today, consumers want to pay as little as possible for an item while the sellers want to get a high price. The theory of product pricing makes provision for changes depending on market conditions. Both supply and demand can fluctuate due to various reasons, sometimes beyond the control of both producers and buyers. When either is too high or low, market forces act upon them to bring a state of equilibrium.

What Is A Pricing Framework?

Setting a price for the products manufactured by a company needs the consideration of several aspects. A successful pricing framework allows the firm to achieve revenue growth and profitability. When the pricing strategy is correctly done as per the theory of product pricing, one can be sure that the product will meet consumer demand, beat competitors and earn profits. It is worth understanding the various pricing frameworks and how an organisation must create the right framework for pricing its products.

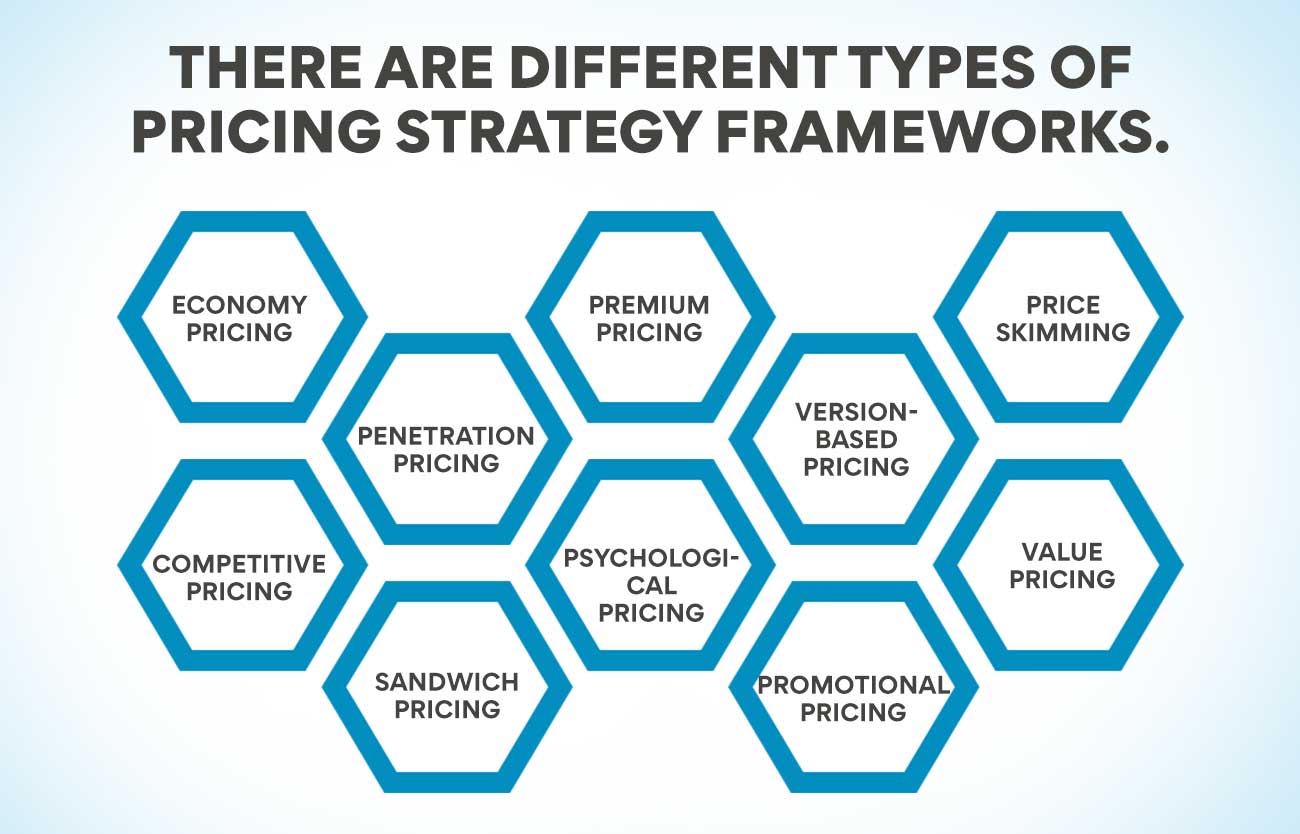

A pricing framework is a model businesses use to set the price for their products or service. A good framework suitable for the company can help boost sales, earn more profits and satisfy the consumer’s changing needs. Organisations consider various factors within a pricing framework to ensure that their pricing appeals to the customers and makes them buy the item. The company considers various aspects like competitor prices, the perceived value of the product, market demand and the firm’s overall goals. There are different types of pricing strategy frameworks.

Economy Pricing – As per the theory of product pricing, this model focuses on low selling prices and low manufacturing and distribution costs.

Premium Pricing – Firms that manufacture and distribute luxury items mostly use this model. The premium pricing framework is used for the perceived value of the product.

Price Skimming – It is the type of framework that allows a company to launch a product with high prices but subsequently reduce the price as competitors enter the market.

Penetration Pricing – In this model, companies enter the market with a low price that will help them enter new markets or new customer segments. As time progresses, these firms will raise the product’s price to reflect better quality and value.

Version-Based Pricing – This is a pricing framework where companies offer various product versions at different prices, often with different features. It helps them cater to customers with different economic backgrounds.

Competitive Pricing – This pricing method is often seen in the service industry where companies price their service to match that of the competitor and offer quality that is sure to beat the competitors.

Psychological Pricing – According to the theory of product pricing, this method helps grab customer attention by pricing the product just below what the buyers perceive as too high.

Value Pricing – These companies understand what the buyers are willing to pay for a particular product or service. They make items that meet the consumers’ standard of value.

Sandwich Pricing – In this pricing model, companies set low, medium and high prices for similar products to lure customers into buying the one in the middle range.

Promotional Pricing – This is offered only once or for a specific period to lure customers into buying the product. It is done either as discounts, sale prices or limited-period offers.

Also Read: 11 Crucial Product Management Metrics and KPIs

How Do Customers look At Your Price?

More than just the producer’s angle is important for pricing a product. Companies must consider how the buyer will view the price of the product. To know this, it is good to classify customers into different types.

The Perfectionists – These people seek long-term value for their purchases. They may spend more money when they purchase the item, but they aim to get the maximum value out of the product. They are very rational about how they view pricing.

Image-Conscious Buyers – These people buy products that are priced higher simply because they are expensive. They want to set themselves apart by buying something exclusive.

The Hedonists – They buy items for fun. They purchase goods just because they can afford them or because they want to. They are not trying to show off.

Frugal Buyers – These are exact opposites of the hedonists. They buy the products that are priced the lowest even if it doesn’t give them much value.

Novelty Buyers – They will buy anything if it provides a new experience. They don’t mind paying more for that. They don’t want to show off but will not mind paying a high price even if the product doesn’t give them value in the long term.

Impulse Shoppers – As the name suggests, they don’t think before they buy an item. They are attracted to products that are priced at something like Rs. 99/-. Companies go out of their way to make sure that their pricing strategy doesn’t allow impulse shoppers to have second thoughts.

Confused Buyers – They are overwhelmed by the idea of making a purchase decision. They may pay more price for a known brand because it gives them the comfort of familiarity. They don’t rationally think about the value the money gives.

Loyal Shoppers – These customers keep buying the same products because it gives them the comfort of familiarity. Unlike the confused buyer, these people don’t escape from making a decision. They consider the price with a rational mind.

An aspiring product manager can learn a lot about different kinds of buyers in the Advanced Executive Certificate Course In Product Management. You can learn more about the course from our website. Now that we have seen the different pricing models and customer types, it is not time to see the step-by-step pricing process.

A Detailed Guide To Product Pricing

- Calculate The Direct Costs

This is a simple step because all the numbers are visible to you. The direct costs will include the cost of raw materials, taxes and other statutory charges, transporting charges and the labour cost for making the goods.

- The Cost Of Sales Or Cost Of Goods

As per the theory of product pricing, the cost of goods or sales represents the cost of the item that is ready for sale. For a retailer or manufacturer, the cost of goods will include the direct costs and other expenses like labour costs, freight costs and factory overheads incurred for the manufacture of the goods and delivery to the customers. Another component to be included is the amortisation expenses or more commonly called depreciation. This relates to the cost of equipment and facilities.

For a distributor or wholesaler, this will include direct costs plus transporting, storage, equipment, supplies and labour costs. Amortisation expenses must also be included in the cost of sales. In this case, the direct cost will mean the cost of goods that the wholesaler buys from the manufacturer.

- Calculating The Gross Profits And Gross Margins

The cost of goods or sales is very important in calculating gross profits and gross margins. The gross profit is arrived at by reducing the cost of goods or sales from the revenue earned by selling a product. This amount is what is left from your revenue for marketing, selling and administration expenses. Your profits also come from this amount. The gross margin is a percentage representation of the gross profits.

Gross Profits = Total Revenue – Cost of Goods or Sales

Gross Margin = Gross Profits / Total Revenue X 100

- Calculating The Break-Even Point

Most businessmen know about the main costs that are involved in making or sourcing a product. But they don’t include the overhead costs that eat into profits. These overheads include the fixed cost that a business incurs for running and going to the market. These don’t change with manufacturing or sales volumes. In the theory of product pricing, these are referred to as fixed costs. These costs must be included when calculating the break-even point, which is the revenue a company must earn to take care of all direct and indirect costs without earning any profit. The indirect fixed costs include:

- Salaries and benefits paid to staff

- Marketing and advertising expenses

- Rent and maintenance charges

- Depreciation on office equipment

- Insurance and professional fees

- Determine The Mark Up

Markup is always mentioned as a percentage of the cost of goods or sales. It is fixed in such a way that the company earns a gross profit that allows it to cover the indirect fixed costs and also earn a profit. Once the business knows the cost of goods and the break-even point, it is easy to fix a markup. Before setting the markup, companies must have a fairly good idea of the number of products they will sell and arrive at an average cost per unit.

Also Read: Product Management Learning- Key Areas

- What Price Is Suitable For The Market?

A business cannot fix a markup just by doing calculations. There is one very important factor that they must consider. Will the market accept the price? If the competitors are selling at a lower price and you are setting a high price to earn more profits, you may sell less quantity. A company can decide to sell fewer numbers at a higher price and make it a premium product. On the other hand, it can sell more numbers at a lower price. This positioning has to be decided by the company as a policy.

The theory of product pricing says that competitive pricing has a huge impact on how a company prices its products. Companies must learn everything about the competitors and what they are offering at the price they charge. This will give an idea as to whether you can charge higher and still sell enough numbers to earn a profit. Companies can charge higher than the competition if they can offer some extra features.

- Check The Prices Regularly

Companies must check their prices regularly. Markets keep changing. The prices of goods and other components also change with time. The organisation must see whether they are still making the profits they desire. It is also good for firms to see if they can still make good profits by reducing the prices and selling more quantity.

You can learn the whole pricing process by enrolling on the Advanced Executive Certificate Course In Product Management offered by reputed institutions. More details about this programme are available on our website.

Conclusion

Pricing is a very important aspect of any product. Companies don’t benefit in any way unless they can make profits by selling their products. They must price the product correctly to ensure that the business makes a profit from it. Understanding the pricing process and the factors that affect it is very important for product managers as they are responsible for the product’s performance. Pricing is also a critical factor in enhancing the customer experience and convincing them that they are getting value for their money.

More Information:

Product Management Frameworks Every PM Must Know

Brand Management v/s Product Management: Know Key Differences